How I hacked my Calendly for child care coverage

I’m always tinkering with my calendar and figuring out new ways to get more out of it. It’s one of my favorite tools at work and home to organize my time and visualize my commitments. At work, I use Calendly pretty regularly to schedule external meetings, since it’s a quick and easy way to carve out availability and share it with others to book. But I had never used Calendly in my personal life until recently, when I tried using it for child care.

Context: my spouse works in academia and every spring he packs a year’s worth of teaching commitments into one quarter. Most of the classes he teaches are during nights and weekends, when we don’t have any regular child care. I’m pretty used to this schedule, but this was our first year doing it with two kids, so I knew I’d want extra help. We’re fortunate to live near family who are happy to pitch in, but I sort of dreaded coordinating the times I wanted help via group chat. So, I decided to give Calendly a try.

Here are the steps that I took to use Calendly for family child care signups.

Step 1: Add Tyler’s teaching schedule to my calendar

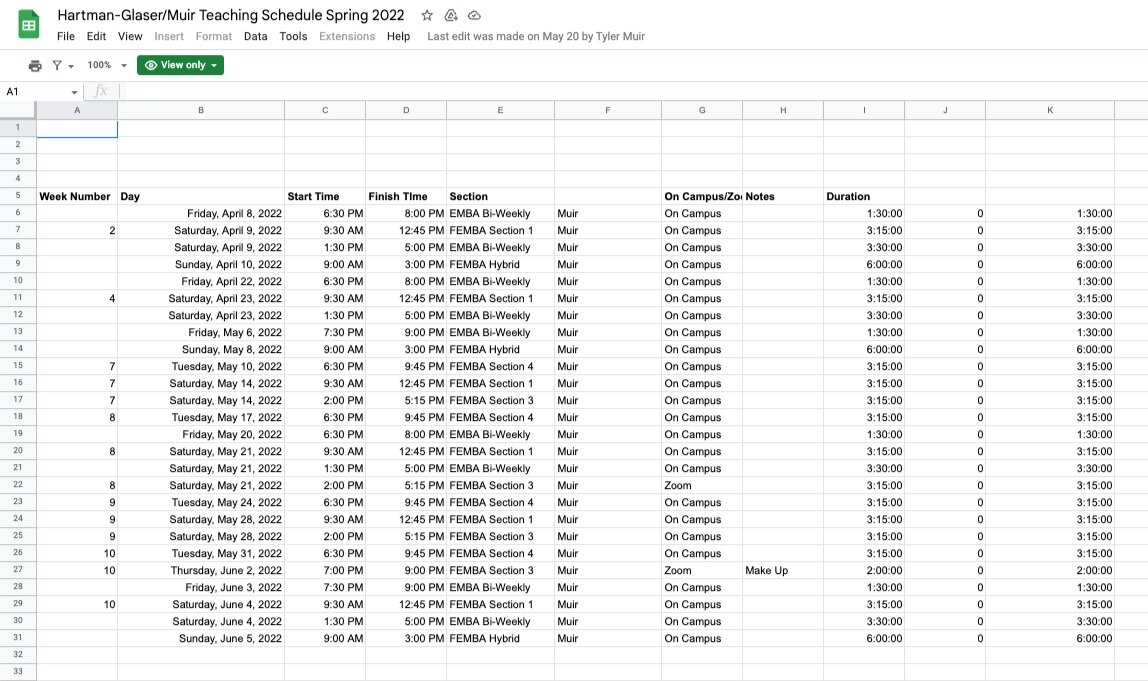

This first step was tedious - manually adding my spouse’s teaching schedule to my personal Google calendar. He gets his course schedule in Excel format, which he shares with me via Google sheets. To add complexity, he has a co-instructor, so only some of the courses are his responsibility. So every year, I manually go through the sheet line by line and manually add each class to my calendar as an event. They have to do this too - there’s no way for faculty (or students) to add their classes to their calendar. It goes without saying that I wish there was an easier way to sync his teaching schedule to my calendar!

Feels wild in 2022 that we are still sharing schedules this way.

Step 2: Figure out when I’d want help

Once I had his schedule in my calendar, I could compare it with my own and figure out when I’d want or need help. This included times I wouldn’t be home because I had an existing conflict, or times I would be home but wanted an extra set of hands for dinner, bath or bedtime with the kids.

Step 3: Create an event in Calendly

Since I already have a Calendly account, I created a new event called “Hanging with Webb & Jackson.” I set the event location to our home address, and made the event private so that it wasn’t publicly available on my Calendly booking page.

Then I built my “availability,” e.g. when I wanted family to sign up for shifts. This part proved to be a bit trickier, since the class lengths varied by day/time and Calendly doesn’t allow for dynamic event lengths. I ended up solving this by making the event itself 179 mins (I initially set it for 3 hours, but had some issues with booking consecutive slots). On evenings, I created availability from 5:30-8:30pm, so only 1 slot would be available. On weekends, depending on how much help I wanted, I created availability starting at 9 or 10am and showed available start times in increments of 3 hours.

Step 4: Share it with my family

This part was easy! I shared the Calendly link on our group text thread.

I did run into one snag here, which is that I’d marked the classes in my calendar as busy, and as a result Calendly didn’t recognize the slots as available. Once I went into my calendar and changed the event visibility to “free” for each class, the issue was resolved.

The outcome

Overall I’m really glad I tried using Calendly for family family child care signups. Even though Calendly was designed for a different use case - booking meetings - it achieved all of my objectives: to share time slots with others easily, to coordinate care without a ton of back and forth communication, and to ensure that the appointment was added to my calendar.

If Calendly were designed for booking child care, here are the features I would have wanted to see, in no particular order:

A different social share picture: ideally, one of the kids! It would have been great to assign a unique photo for this event in Calendly.

Home-or-not indicator: there was no great way to share with family whether or not I’d be home during the shift in question. Anyone who’s babysat knows that this is critical information!

Unique time slot notes: since some of these were during dinner time, it would have been nice to be able to share a note associated with a particular time slot or set of slots - eg, I’ll order pizza from the place down the street, please pick it up on your way here.

Variable event length: this wasn’t a huge issue for weekends, but it would have been nice to not have to commit to 3hr shifts for the whole schedule - I would have preferred that the booker could design their own event length (e.g. 2 hours or 5).

Automatic color coding: it would have been great when scanning my calendar quickly to see which nights and weekends I did/not have help with the kids. I ended up manually changing the confirmed slots to a different color for this reason.

Better shared visibility: I wish there’d been an easy way for family members to see who had already signed up so that they could swap shifts or even double up.

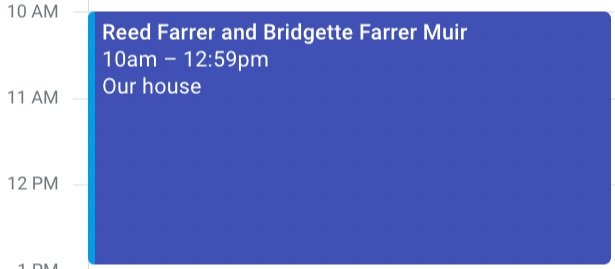

A custom title: the default naming convention for an appointment booked through Calendly is “John Smith and Jane Doe” when John is booking an appointment on Jane’s calendar. It would have been nice to assign a custom name to these events, eg “Reed hangs with Webb and Jackson.”

Given that Calendly was built for booking meetings, I didn’t expect it to be a perfect tool for babysitting signups. But I still think it worked better than what I imagine the alternative would have been (text coordination + Google sheet signup + manual calendar invites).

Now that I figured out how to use Calendly for child care, the next personal thing I want to try is a social calendar for friends, where they can book a weeknight dinner or weekend hang/hike. I’d probably use the same process: create a private Calendly event, add availability (3hr blocks would work well here), and share it with friends via text. This is an easy way to cut down on the back and forth coordination and guarantees that our plans make their way onto my calendar.